On-demand promissory notes don’t have this item.

The date on which the payment is due must be set out clearly (concerning both the whole sum and the installations – if such a payment option is agreed upon).

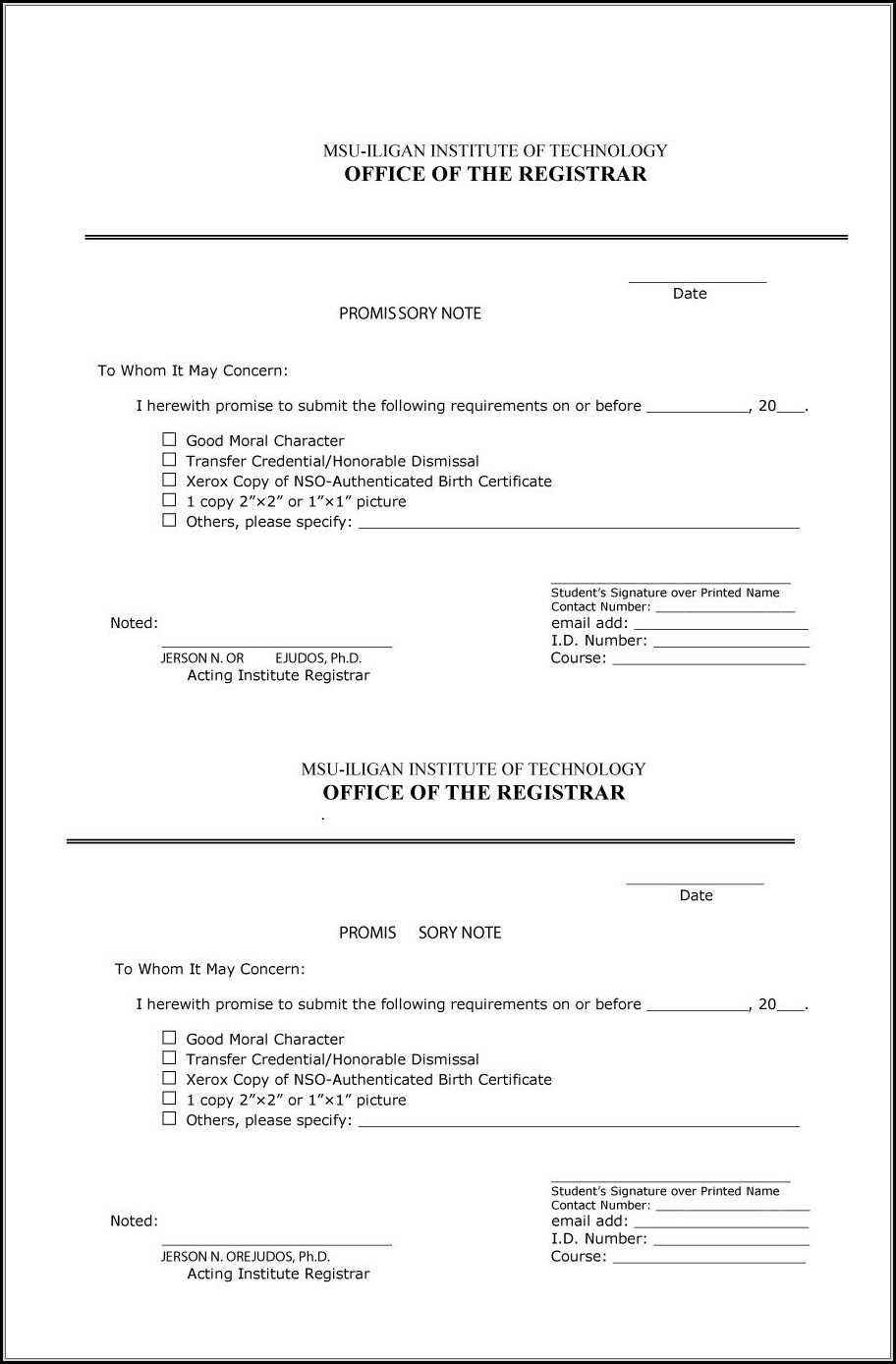

This is the sum that is lent by one side and borrowed by the other. Here, the addresses and phone numbers of the lender and borrower are mentioned. These should be the legal names (titles) of the parties involved in the transaction. That said, we still recommend consulting local legislation because in some minor aspects (like whether the lender must sign the note or not), the states may differ.ĭocuments like that are meant to be legally enforceable, which is why the following elements of them are mission-critical. State laws are pretty much similar in their form and content, so you can make use of standard printable promissory note templates available at PandaDoc. This legal area is considered to be within the jurisdiction of states. In the USA, there are no federal laws regulating the domain of promissory notes. A variety of this note relying on the so-called balloon payment system is typically applied in mortgage loans. It requires a promissory note of installment payments, conventionally on a monthly basis. The second occasion mostly occurs in case the money is used to buy big-ticket items (for instance, electronic devices, appliances, cars, or boats). Use Family Member Promissory Note TemplateĪlso, the lender may want to receive the payback either as the entire sum in one go or agree to split the repayment into portions. The lender may agree to such a note if the borrower has a healthy credit score.Įasily document loans between relatives with our customizable Family Member Promissory Note Template. An unsecured note doesn’t mention any collateral.To ensure fair repayment, the value of the provided collateral should be at least equal to the borrowed amount. If it is the former, the borrower has to relinquish some collateral (goods, services, or property) if they fail to pay back the borrowed sum.Promissory Notes by Typeĭepending on the mentioning of some assets that safeguard the return of the borrowed money, promissory notes can be secured or unsecured. Such high-level papers tend to be rather sophisticated forms that are often accompanied by other documents, such as a shareholder agreement, a security agreement, an asset purchase contract, or an NDA. That is why it is a crucial element of deals involving mortgages, car loans, student loans, and a number of business loans in the realm of real estate, commerce, investment, etc. But when it goes about big-time business or a large amount of cash changing hands, such documents are an absolute must. When to Use a Promissory NoteĪ simple promissory note may come in handy when a person lends a certain sum of money to a friend or relative. A typical promissory note example specifies the amount, frequency, payment schedule and deadline, as well as other information related to the agreement. A promissory note form (sometimes also called a loan agreement or IOU) is a legally-binding document whose purpose is to make sure a lender will receive the money (plus the interest) from the person or organization they have lent the money to.

0 kommentar(er)

0 kommentar(er)